A Comprehensive Guide to Identifying Red Flags for Startup Investors

Investing in startups represents a unique blend of opportunity and risk. For every successful venture, there are countless others that don’t make the cut. As an investor, it’s critical to be aware of potential red flags that could spell trouble for your investment. This comprehensive guide will explore 18 red flags that every startup investor should be wary of.

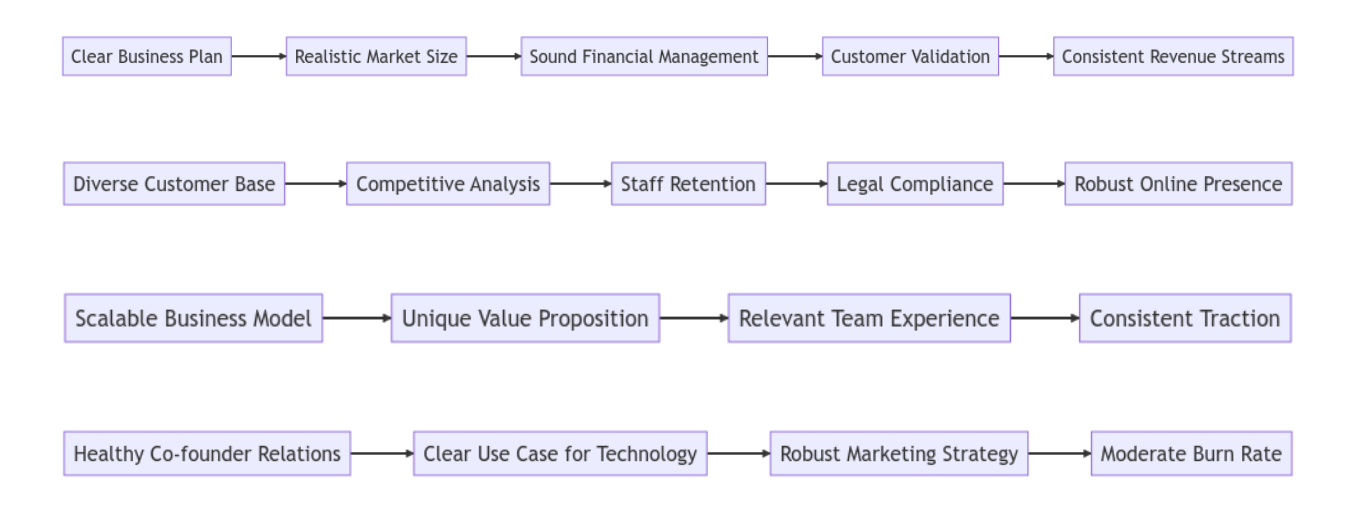

The Red Flags: Key Considerations for Startup Investors

1. Lack of a Clear Business Plan

A clear business plan is the foundation of any successful startup. If a startup cannot articulate its business model, target audience, revenue streams, and growth strategy, it’s a sign of potential problems down the line.

2. Overconfidence in Market Size

While optimism is necessary in a startup, overestimating the market size can lead to unrealistic expectations and faulty decision-making. A startup that hasn’t properly validated its market size is a risk.

3. Poor Financial Management

A startup should have a clear financial roadmap, and a competent team to manage funds. If there’s evidence of poor financial management, such as haphazard spending or lack of financial projections, investors should be cautious.

4. Inadequate Customer Validation

Without robust customer validation, a startup’s product or service may not meet market demand. Startups that don’t invest in understanding their customers’ needs may struggle to achieve product-market fit.

5. Inconsistent Revenue Streams

Inconsistent or unclear revenue streams can be a sign of an unstable business model. A startup should have a realistic plan for generating consistent revenue.

6. Overdependence on Key Customers

While having major customers can be beneficial, overreliance on a few can lead to instability. Startups should aim for a diverse customer base to safeguard against potential losses.

7. Lack of Competitive Analysis

Failing to analyze competitors can leave a startup unprepared for market challenges. A comprehensive competitive analysis is essential for understanding the startup’s position in the market.

8. High Staff Turnover

High staff turnover can be a sign of internal problems. If a startup can’t retain its team, it could face issues with continuity, morale, and productivity

9. Inadequate Legal Compliance

Startups must comply with all relevant legal and regulatory requirements. Non-compliance can lead to fines, penalties, and reputational damage.

10. Weak Online Presence

In today’s digital age, a weak online presence can hinder a startup’s growth. A lack of a robust digital strategy can impact customer acquisition, brand recognition, and trust.

11. Absence of a Scalable Business Model

A startup without a scalable business model may struggle to grow or adapt to market changes. Investors should look for startups with business models that can scale efficiently.

12. No Unique Value Proposition

Startups need to offer something unique to stand out in the market. Without a unique value proposition, a startup may struggle to differentiate itself from competitors.

13. Lack of Relevant Experience

The startup team should have relevant industry experience. Lack of experience can lead to poor decision-making and increase the risk of failure.

14. Limited Traction

Limited traction in terms of user growth, customer acquisition, or revenue can be a warning sign. Investors should look for evidence of steady, consistent growth.

15. Unresolved Co-Founder Conflicts

Conflicts among co-founders are not uncommon in the startup world. After all, high stakes, long hours, and pressure can strain any relationship. However, unresolved or frequent conflicts between co-founders can signal deeper issues and pose a serious risk to the startup’s success.

16. Overly Complex Technology Without a Clear Use Case

Complex technology can be a powerful asset for a startup, but only if it has a clear and practical use case. If a startup is developing complex technology without a solid plan for how it will benefit users or generate revenue, this could be a red flag for investors.

17. Lack of a Robust Marketing Strategy

Complex technology can be a powerful asset for a startup, but only if it has a clear and practical Marketing is essential for any startup to reach its target audience, generate interest, and convert leads into customers. A lack of a well-defined marketing strategy could signify a startup’s lack of preparedness for the competitive business environment.

18. Excessive Burn Rate

A startup’s burn rate, or the rate at which it spends its capital, is a vital factor to consider. An excessive burn rate, especially without commensurate growth or a clear path to profitability, can quickly drain a startup’s resources and increase financial risk.

Leveraging Wholesale Investor’s CRIISP Dealroom for Effective Due Diligence

Wholesale Investor’s CRIISP Dealroom is a powerful platform designed to streamline the investment process, making it easier for investors to conduct thorough due diligence and mitigate potential risks. Our sophisticated software solution can be instrumental in helping investors navigate the red flags identified in this guide.

CRIISP is designed to streamline the due diligence process. Investors can directly access the necessary documents, data, and metrics for thorough analysis. The software offers structured data rooms, ensuring that all the required information is organized and easy to find.

Moreover, CRIISP’s secure platform ensures that all data shared during the due diligence process is protected, respecting the confidentiality and integrity of the information.

Ironing Out Red Flags with CRIISP Dealroom

With CRIISP, investors gain access to a suite of tools that can assist in uncovering and addressing potential red flags:

Access Comprehensive Startup Profiles: CRIISP provides detailed profiles of startups, complete with their business plans, market size estimations, financial management strategies, customer validation efforts, revenue streams, and more. This information can help investors identify red flags such as lack of a clear business plan or overconfidence in market size.

Direct Communication Channels: CRIISP facilitates direct communication with startup founders, enabling investors to ask critical questions and seek clarifications. This open line of communication can help resolve potential issues like co-founder conflicts or lack of relevant experience.

Transparent Financials: The platform also supports transparency into a startup’s financials, helping investors assess the startup’s financial management and burn rate. This can illuminate red flags like poor financial management or an excessive burn rate.

Conclusion

Investing in startups is not without its risks, but armed with the knowledge of these 18 red flags, investors can make more informed decisions. It’s important to conduct thorough due diligence before making any investment decisions. Understanding and identifying these red flags can help investors mitigate potential risks and maximize the potential for a successful return on their investment.

Remember, while these red flags serve as a guide, they’re not definitive. Each startup is unique, and what might be a red flag in one situation may not be in another. Ultimately, a thorough evaluation of the startup’s overall potential, considering these red flags, should inform your investment decisions.

Backed By Leading Investment Groups and Family Offices